An Unbiased View of Top 30 Forex Brokers

An Unbiased View of Top 30 Forex Brokers

Blog Article

Examine This Report about Top 30 Forex Brokers

Table of ContentsWhat Does Top 30 Forex Brokers Mean?Top 30 Forex Brokers for BeginnersFacts About Top 30 Forex Brokers UncoveredThe 20-Second Trick For Top 30 Forex BrokersThe Buzz on Top 30 Forex BrokersExamine This Report about Top 30 Forex BrokersSome Of Top 30 Forex BrokersThe Definitive Guide to Top 30 Forex Brokers

Each bar graph represents one day of trading and consists of the opening price, highest possible price, lowest rate, and shutting price (OHLC) for a profession. A dash on the left represents the day's opening rate, and a similar one on the right stands for the closing cost.Bar graphes for currency trading assistance investors recognize whether it is a buyer's or vendor's market. The upper part of a candle light is made use of for the opening cost and greatest rate point of a money, while the reduced part shows the closing price and cheapest price factor.

See This Report on Top 30 Forex Brokers

The developments and shapes in candle holder graphes are made use of to determine market direction and motion.

Financial institutions, brokers, and dealerships in the forex markets allow a high quantity of leverage, implying investors can manage big positions with relatively little money. Leverage in the range of 50:1 is usual in foreign exchange, though even higher amounts of leverage are offered from certain brokers. Leverage must be made use of meticulously since many unskilled traders have actually experienced significant losses making use of even more leverage than was essential or sensible.

The Buzz on Top 30 Forex Brokers

A money investor needs to have a big-picture understanding of the economies of the various countries and their interconnectedness to comprehend the fundamentals that drive money worths. The decentralized nature of foreign exchange markets implies it is much less regulated than other financial markets. The degree and nature of policy in forex markets rely on the trading jurisdiction.

The volatility of a certain currency is a function of multiple factors, such as the national politics and business economics of its country. Occasions like financial instability in the kind of a settlement default or imbalance in trading connections with another money can result in substantial volatility.

The Top 30 Forex Brokers Statements

The Financial Conduct Authority (https://www.viki.com/users/top30forexbs/about) (FCA) screens and regulates foreign exchange sell the United Kingdom. Money with high liquidity have a prepared market and display smooth and foreseeable cost activity in feedback to outside events. The U.S. buck is one of the most traded currency worldwide. It is paired in 6 of the market's seven most liquid money pairs.

A Biased View of Top 30 Forex Brokers

In today's info superhighway the Foreign exchange market is no more entirely for the institutional financier. The last ten years have actually seen a rise in non-institutional traders accessing the Forex market and the benefits it provides. Trading platforms such as Meta, Quotes Meta, Investor have actually been developed continue reading this specifically for the exclusive financier and academic material has actually ended up being quicker available.

The Definitive Guide to Top 30 Forex Brokers

Forex trading (foreign exchange trading) is a global market for dealing money. At $6. 6 trillion, it is 25 times bigger than all the globe's securities market. Foreign exchange trading determines the currency exchange rate for all flexible-rate money. As a result, prices transform continuously for the money that Americans are probably to make use of.

All money professions are carried out in pairs. When you offer your money, you get the settlement in a various currency. Every traveler that has actually obtained international money has done foreign exchange trading. When you go on vacation to Europe, you exchange bucks for euros at the going price. You market united state

The 3-Minute Rule for Top 30 Forex Brokers

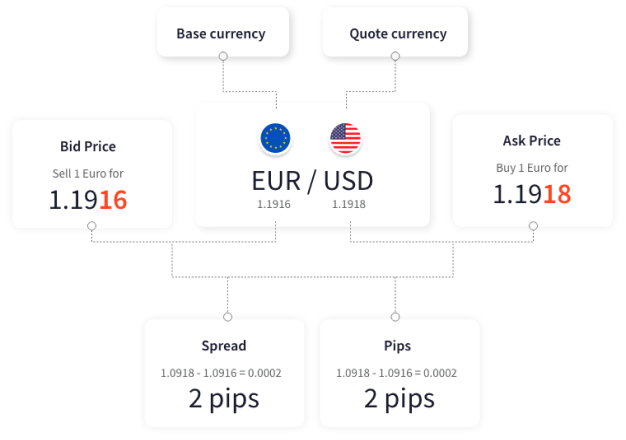

Place deals are comparable to exchanging money for a trip abroad. Spots are agreements between the investor and the marketplace maker, or dealer. The investor purchases a certain currency at the buy price from the market manufacturer and sells a different currency at the asking price. The buy price is rather more than the asking price.

This is the purchase cost to the trader, which in turn is the revenue earned by the market manufacturer. You paid this spread without understanding it when you exchanged your bucks for foreign money. You would observe it if you made the transaction, terminated your journey, and afterwards attempted to exchange the currency back to bucks right now.

Rumored Buzz on Top 30 Forex Brokers

You do this when you think the money's worth will certainly drop in the future. If the money increases in value, you have to get it from the supplier at that price.

Report this page